According to a Deloitte survey, corporations are beginning to consider a broader set of stakeholders which reflects not just economic performance but also societal impact. Approximately 70% of C-suite executives surveyed believe that long term business success requires the integration of Industry 4.0 technologies into their organisations.

Industry 4.0 is the marriage of physical assets and digital technology and with this data in hand, corporations are more productive, more innovative and better equipped to operate in a circular economy which according to the World Economic Forum (WEF) “promotes the elimination of waste and the continual safe use of natural resources, offers an alternative that can yield up to $4.5 trillion in economic benefits to 2030.”

A recent report from the WEF shows how the power of Industry 4.0 can be harnessed to improve the way materials are managed and steer society away from antiquated take‑make‑waste models towards sustainable, circular solutions.

We consider the shift to circular manufacturing, which requires a connection between physical and digital assets for effective measurement and therefore management, as a nascent yet powerful megatrend which will gain more prominence over the next several years.

STOCK IN FOCUS: PTC Inc (PTC US, $13.8b Market Cap)

One of our Ellerston Global holdings is PTC, a global leader in Computer Aided Design (CAD) and Product Lifecycle Management (PLM) software products and the leader in providing solutions serving the high growth Industrial IoT and Augmented Reality (AR) markets associated with Industry 4.0. The CAD and PLM market is dominated by four global players, including PTC which has demonstrated continued market share gains as it excels in helping customers design, manufacture, operate and service products across multiple industries. While it delivers its solutions via a software stack, the underlying business is really driven by industrial activity and innovation.

PTC has three significant partnerships with industry leaders including Microsoft, Rockwell Automation and Ansys. We consider its partnership with Microsoft as the largest driver of near-term revenue contribution as PTC’s ThingWorx® Industrial Innovation Platform is now available on the Microsoft Azure cloud platform as its preferred cloud platform.

The business has really transformed over the past few years as Management made the hard decision to move from a perpetual licence model to a recurriing revenue subscription product offering. This had the result of constraining top line growth and margins in the early days however in FY20 the model inflected wth EBIT margin increasing almost 900bps and annual recrurring revenue growing double digit despite the impact of the global pandemic.

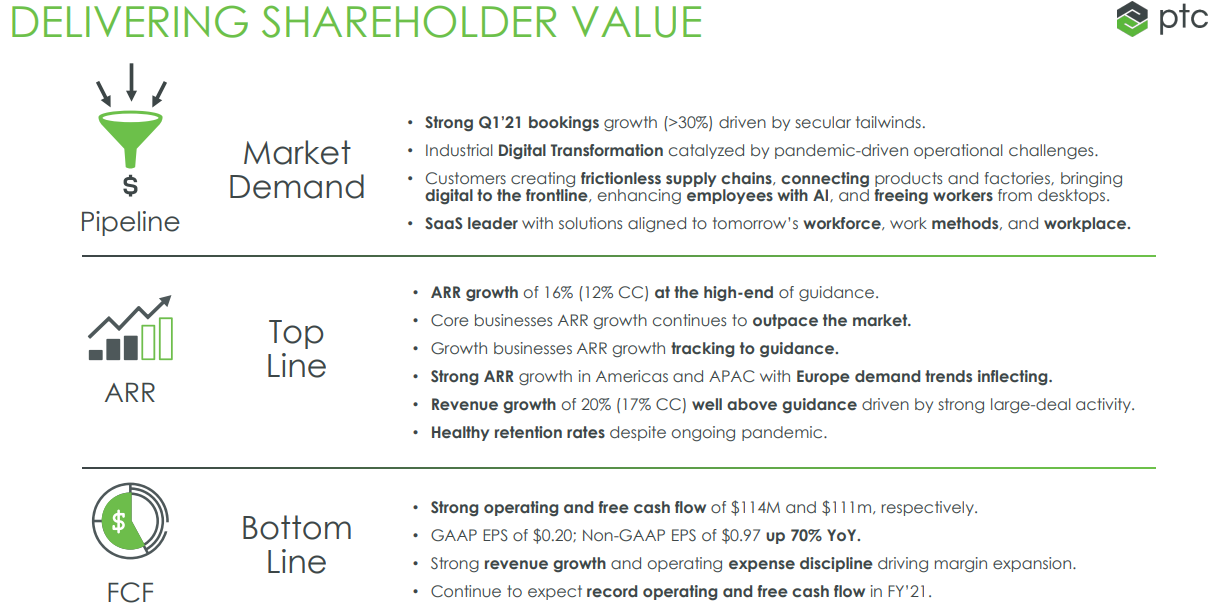

FY21 has started out well for the business with Q1 revenue and EBIT up 20.5% and almost 65% respectively prompting Management to upgrade guidace quite materially compared with its last full year expectation. Recent acquisitions including OnShape and Arena are expected to drive outsized growth as the combination represents a powerful pure-SaaS solution that’s number one in technology, customers and revenue.

Source: PTC Q1 21 Earnings Presentation

Its core CAD and PLM business is expected to grow high-single digit to low double-digit over the coming years while the higher growth Augmented Reality group is expected to come in between 25-30% and represent close to a third of the total business in a few years. This should drive operating leverage across its “build it once, sell it many times” software stack with Management anticipating a further 700bps margin expansion over the coming years which subsequently drives 25-30% FCF growth for us as shareholders.

At the time of writing, PTC is trading at $125.50 which represents a forward PE of 28x and EV/EBITDA of 15.4x which we consider solid value for a business growing 30%+ over the next few years and roughly half the multiple as its best comparable Autodesk. As FCF continues to build on the balance sheet (excluding any further M&A) we anticipate the balance sheet to be in a net cash position in two years which provides significant capital allocation optionality for the group.