India Consumer Trip

The India Consumption story is one of the most compelling structural growth stories in the world and the sector has consistently been an important feature of our Asia & India funds.

It is important to note that India Consumer is not a homogenous group (urban vs rural, male vs female, young vs old, high income vs low income) so a deeper understanding of their consumption patterns will result in more targeted stock picks in different phase of the cycle. Over the past 5 years, we have seen the likes of Hindustan Unilever (largest FMCG company) and Maruti Suzuki (largest auto company) increasing their market cap by ~150% on average. Backed by the sheer size of India’s youth (450m Millennials and 470m Gen Z), the growth has been driven by:

1) premiumisation,

2) increasing penetration, and

3) better product availability and accessibility.

However, in recent quarters we have seen a drastic slowdown in the sector where volume growth has moderated from ~10% to ~5%. As such, our Senior Investment Analyst, Eric Fong, spent a week in India to meet with companies and conduct channel checks to understand more about the recent trend in the sector. His conclusion is that the slowdown will be here to stay for the next 1-2 quarters and the best investment opportunities continue to stay with high quality market leader stocks.

After speaking to 25 companies, here are his 3 key observations from the trip:

1. No sign of recovery for consumer staples

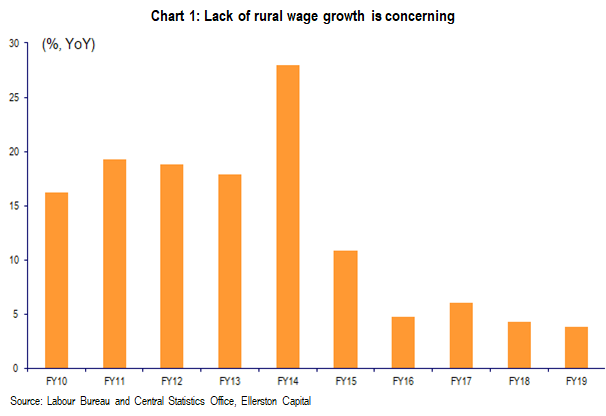

India consumer staples have grown its revenue by 15-20% CAGR from 2008 to 2015 driven by rising disposable incomes, increasing contribution from rural India and expansion in distribution network.

However, in recent years we have seen a moderation in growth down to single digit as the sector faced a number of disruptive events – weak monsoon (2014-2018), demonetisation (2016), GST introduction (2017), NBFC liquidity crisis (2018), and has led to a broader macro slowdown represented by 5 consecutive quarters of GDP deceleration. The feedback on the ground is that most staples companies are not seeing signs of demand recovery even though supply side is improving due to better liquidity. Rural, in particular, has underperformed urban for the last couple of quarters due to weak wage growth and low food inflation. There is hope that the slightly positive monsoon will stabilise the rural demand but no companies are expecting a sharp recovery in the next few quarters. Notably, a government official from the Ministry of Finance also suggested that the upcoming policy setting would likely be more focused on exports as consumption has now somewhat peaked at ~59% as contribution of GDP. Not all channel checks are negative however – a handful of companies are seeing strong growth momentum due to company specific reasons. For example, cinema operator PVR, which we own in our India Fund, is not seeing much of the macro impact as their target audience (i.e. premium segment) is not overly sensitive to GDP growth, whether it is 5% or 7%.

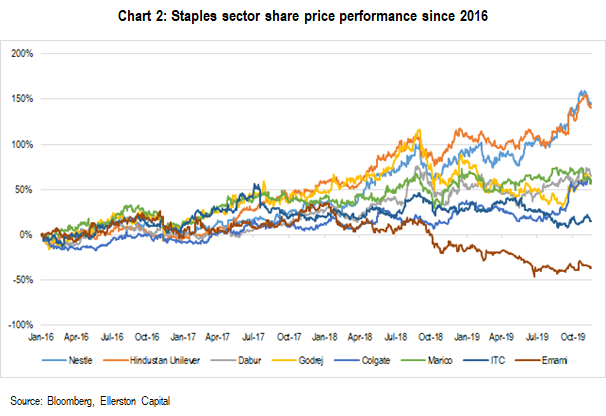

On valuation, most consumer staples stocks have remained elevated in terms of PE despite the macro headwinds. We have seen some crowding in the high quality names as investors are favouring quality and execution while several other names are plagued by governance issue (e.g. Emami, Zee Entertainment). We remain cautious on consumer staples given the rich valuation and weak macro but will closely watch for any signs of sustained demand recovery.

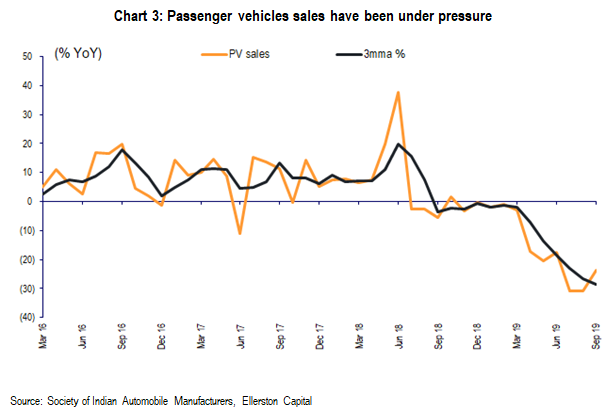

2. Auto under pressure

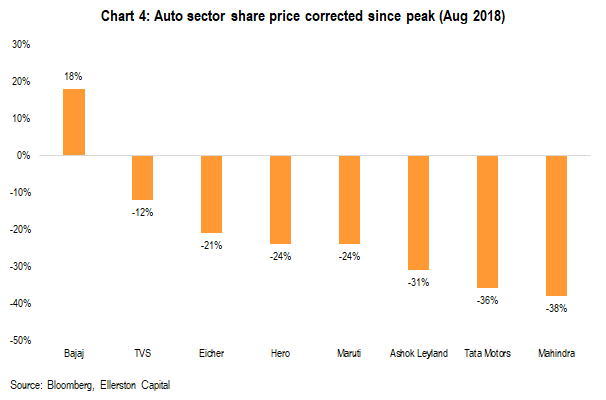

Auto has experienced the most severe slowdown in a decade as the sector has been struck by a perfect storm. The sector has posted negative growth for 11 consecutive months and share price was corrected by ~25% on average. The industry weakness is caused by a confluence of disruptive factors:

- Federal election – consumers postponed their purchase leading up to election;

- Tax confusion – consumers were hoping for a tax cut so they held back on purchase from Jun to Sep;

- Regulation – anti-lock braking system (ABS) for all models, rising insurance cost, and one-time road tax means that entry level products have seen ~20% price hike;

- Non-Banking Financial Company (NBFC) crisis – credit was tightened during the liquidity crisis; and

- Emission norm transition – the industry will move to BS6 emission standard and no more BS4 vehicles will be sold post 1 April

All these have substantially disrupted the sector in the space of 12-18 months on top of the general macro slowdown so we have seen sharp correction in the auto sector. The feedback on the ground is that the October festive season performed slightly better than expected but visibility remains low post festive season. There will be another round of inventory disruption ahead of BS6 implementation on 1 April as any non-BS6 compliant inventories will need to be written off hence this has also distorted consumer behaviour as some would defer purchase in anticipation of fire sales.

Whilst there appears to be more pain ahead for India auto, the cyclical nature of the sector means that the market tends to overreact on good or bad news. As we are now edging towards the end of the down cycle, there are more reasons to be hopeful on India auto.

3. Long term opportunities remain intact

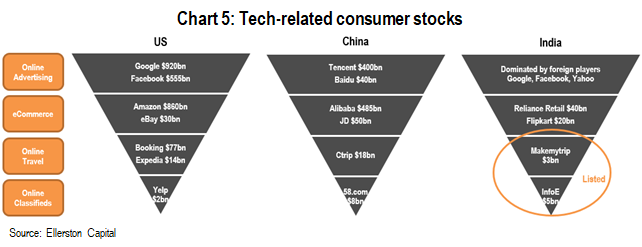

Despite the negative cyclical headwinds in the near term, we are still positive on India consumer in the longer term given the ongoing premiumisation trend and low penetration for certain consumer categories. In our view, current slowdown and regulation changes present an excellent opportunity for high quality market leaders to further consolidate their competitive positions, such as the ongoing shift from unorganised to organised sectors post GST implementation. These companies tend to have financial flexibility to execute their long term business strategy and are willing to invest in product innovation and transformation of distribution channels such as eCommerce. Whilst we are constructive on the sector, we are mindful of a potential change in investible universe. Currently the Indian consumer universe is rather narrow, unlike China with the likes of Alibaba and JD. As a result, the high valuation multiple on consumer staples is driven partly by scarcity value and quality. We will closely watch for the potential listing of tech names such as Reliance Retail and Flipkart as this will have a major impact on fund flows in the space.

Conclusion

Our on the ground feedback suggests that demand environment for Indian consumer has not recovered though the recent festive season was better than feared. We expect another 1-2 quarters of weakness before we see any sustained demand recovery. In terms of stock picks, we remain cautious in the sector and continue to favour high quality market leaders as they further consolidate their market leadership positions during this down cycle.

Ellerston Capital Limited ABN 34 110 397 674 AFSL 283000 is the responsible entity and issuer of units in the Ellerston Asia Growth Fund ARSN 626 690 686 and the Ellerston India Fund ARSN 618 549 796. Any information is general and does not take into account your personal objectives, financial situation or needs. Accordingly you should consider the Product Disclosure Statement before deciding whether to acquire or continue to hold units in the Fund available from this website or by contacting us on 02 9021 7797. Past performance is not a reliable indicator of future performance.