Asia Technology Trip

Asia is the most technology heavy region in the world. Technology companies currently make up ~37% of the MSCI Asia ex Japan Index compared to only ~2% of the MSCI Australia.

Asian technology companies are typically high growth, with an average earnings (EPS) growth in 2020 of ~25%. They also trade on reasonable multiples, with an average forward price to earnings (PE) ratio of 26x and thus implying a growth adjusted (PE divided EPS growth or PEG) multiple of 1.1x. As such, technology companies meet the growth criteria of the Ellerston Asian Portfolio. Indeed, technology stocks currently comprise 42% of the Portfolio.

Given a large portion of the portfolio is invested in the technology sector, the Ellerston Asia team spends a significant amount of time on the ground meeting technology companies and doing various channel checks. On September 16-19, Deputy Portfolio Manager, Fredy Hoh visited Taiwan and Korea and met with 18 technology supply chain companies. The three key takeaways from the trip were:

1. Huawei has been aggressively stockpiling components in response to the US trade sanctions

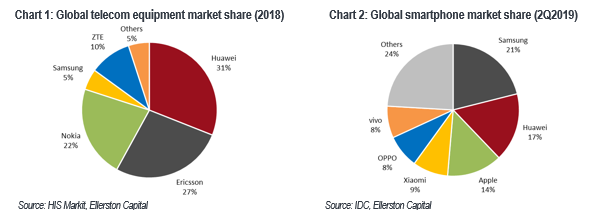

Huawei is the world’s largest supplier of telecom equipment and the second biggest maker of smartphones (yes, it’s larger than Apple!). Like Apple, Huawei has an extensive supply chain of over ~250 companies producing components that go into its products (Charts 1 and 2).

Every Huawei supply chain company we met on this trip has seen increased orders from the company in recent months. Much of this demand uplift reflects stockpiling ahead of the US Temporary General License Expiry on November 19. This license granted by President Trump has allowed US supply chain companies to supply critical components to Huawei for the past 3 months. In response, Huawei has built up inventory in order to continue producing smartphones and base stations even if the license does not get renewed. This stockpiling has also served to buy Huawei some time to either develop its own technologies or to find credible non-US suppliers for components such as radio frequency transceivers, power amplifiers, specialty chips and software.

Our base case is for the US to grant another 90 day extension as prelude to a ‘Phase 1’ trade deal with China. If so, Huawei is likely to continue with its aggressive inventory build and this should underpin solid near term revenue growth for a number of the supply chain companies that Ellerston Asia owns such as TSMC, Mediatek and King Yuan.

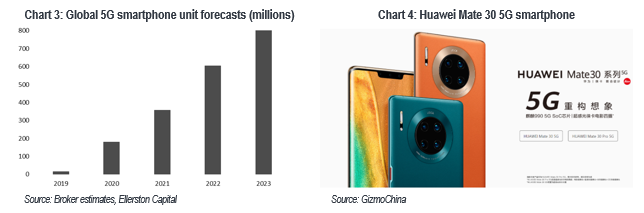

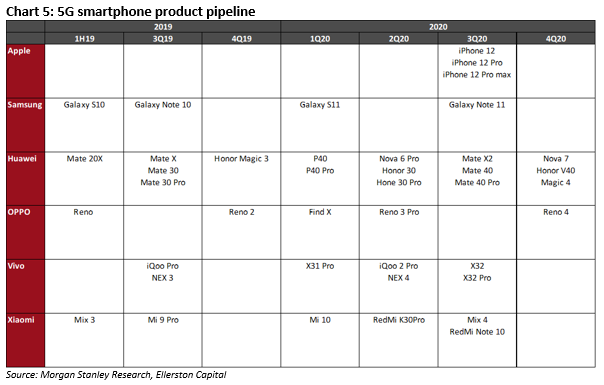

2. The 5G era has arrived

The recent order strength from Huawei has also been driven by the step change in China’s 5G infrastructure build out. 5G represents the next major advancement in mobile communications and is characterised by significantly faster download speeds (1-10Gbps) and low latency (<1 millisecond). This trip provided tangible evidence that the 5G story has shifted from a potential thematic tailwind to an actual earnings driver for many Asian technology companies. Most investors (including us) had initially thought 5G would be a 2020/21 story, but the Chinese Government’s accelerated deployment of 5G infrastructure over the past 6 months has forced other Governments around the world to be more proactive with their respective 5G rollouts. The US, Korea, Germany, UK and China have already launched 5G services. Other countries including Australia are likely to introduce 5G services in 2020. The widespread commercialisation of 5G over the coming 12 months will be helped by the release of 5G enabled smartphones from Apple, Samsung, Huawei, Oppo, Vivo and Xiaomi. In fact, up to 200m 5G devices could be sold in 2020 and this number could double to 400m in 2021 (Chart 3).

What this means for Asian tech companies is that there is now genuine demand for components used in 5G base stations and smartphones and this should benefit companies such as TSMC, Samsung Electronics, Mediatek, King Yuan and SK Hynix.

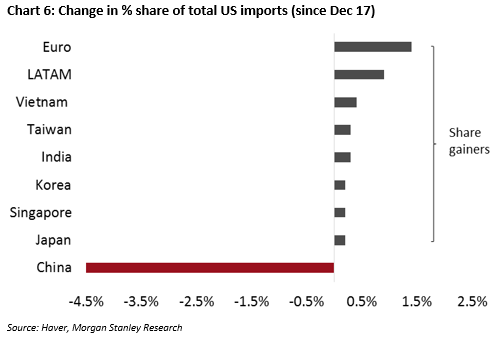

3. Supply chains are shifting in Asia

The technology supply chains are structurally changing from a “China-only” to a “China +1” model. Asian technology companies have had over a year to plan for a scenario where US trade tariffs on Chinese exports are permanently in place. Specialised and skilled manufacturing lines will remain in China because no other country can fully replicate the scale of China’s production base. But some supply chain companies have been proactively moving certain value added assembling capacity out of China, mostly to Taiwan and Vietnam. Indeed, we have seen in the data that both Taiwan and Vietnam have gained share in the US import market at the expense of China since 2018 (Chart 6). Other countries such as Thailand, Malaysia, Philippines and Indonesia have been cited as future beneficiaries of this shift away from China, but they currently either lack the skilled labour population or the necessary infrastructure to make it viable.

By shifting production to elsewhere in Asia, suppliers can help customers avoid paying tariffs because the country of origin and most of the value added will occur outside of China. This move however will result in higher costs for suppliers and could therefore be a structural drag on margins. Companies that have shifted production outside of China include Hon Hai, Inventec, Quanta, Bizlink, Accton, Compal, Delta Electronics, Goertek and Luxshare.

This trip gave us comfort that the Ellerston Asian Portfolio is positioned in the right parts of the technology supply chain. We have exposure to the Huawei and 5G thematics through TSMC, Largan, King Yuan, SK Hynix and Samsung Electronics. We also have very little exposure to the supply chain shift thematic given the potential margin headwinds.

Ellerston Capital Limited ABN 34 110 397 674 AFSL 283000 is the responsible entity and issuer of units in the Ellerston Asia Growth Fund ARSN 626 690 686. Any information is general and does not take into account your personal objectives, financial situation or needs. Accordingly you should consider the Product Disclosure Statement before deciding whether to acquire or continue to hold units in the Fund available from this website or by contacting us on 02 9021 7797. Past performance is not a reliable indicator of future performance.