In our latest Ellerston Global & Morphic Funds webinar, Bill Pridham, the Funds’ Portfolio Manager, recapped the case for investing in Global Mid Small Caps, detailed some of his portfolio considerations and provided an update on the Funds’ positioning and performance up to June 2021. If you were unable to join, you can read the key takeaways and view the recording below.

The Global Mid Small Cap market

One of the biggest misperceptions about Global Mid Small Caps is size and risk and the slide below provides some context by comparing a few of our companies with some Australian counterparts.

If you look at Cochlear it is a ~ US$ 12bil market cap company. Stockland is ~ US$ 8bil market cap and Qantas is ~ US$ 6.6bil market cap.

Our Funds (Ellerston Global & Morphic) have positions in Bureau Veritas, based in France, ~ US$ 14bil market cap, PTC in the US ~ US$ 16.5bil market cap and Sensata also in the US ~ US$ 9bil market cap.

The Mid Small Caps globally are typically multibillion dollar market cap companies, operate on global scale and typically in very solid sector and growth markets.

When you think about our portfolio, the average market cap is US$8.7 billion (~AU$11.5bil) and if we were take that portfolio as a single stock and put it on the ASX it would be just outside the top 50.

The reason they are classified as Mid Small Caps overseas is because they operate in markets which include Apple (US$2.4 trillion market cap) and Microsoft (US$2.1 trillion market cap).

Diversification Benefits

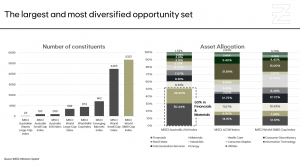

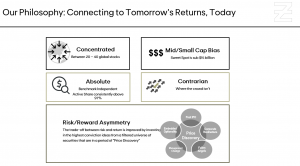

Investing in Global Mid Small Caps provides portfolio diversification benefits. There are simply a lot of companies to choose from. The ASX 200 has 200 companies but we have thousands of companies offshore to choose from and the beauty is that a lot of them don’t have a lot of research coverage.

In a Mid Small cap stock you might have a handful of analysts cover it (one of our companies has 2 analysts covering it) and when you compare that to mega caps, there is significantly more coverage with up to 60-70 analysts plus all the buy side analysts’ providing news flow on the stock. We find this lack of coverage and research really suits our Price Discovery strategy because it gives us the opportunity to look at these companies in a lower information flow environment and the added benefit of time to look at these companies and what they can be longer term.

The other aspect of diversification is concentration. If you look at the ASX 200, roughly 50% of it is in Financials & Materials (majority is big Banks, BHP & Rio Tinto).

The asset allocation profile of the MSCI World and MSCI Small and Mid Cap indices provides significant diversification benefits from an exposure point of view. This leads to potential attractive investment opportunities in global technology, health care, industrial and consumer discretionary businesses offshore.

To sum up, investing in a bigger more diversified opportunity set should be an important consideration for your portfolios. When you think about your domestic portfolio, it is very well diversified in terms of large cap and smaller cap companies; the same thing needs to be done offshore: if you have some very strong mega cap companies like Facebook, Google & Apple which are great franchises, you should also diversify your portfolio and own the complete set as many of the companies that we own will support them or benefit from their growth as well.

An additional advantage is that you don’t have to give up returns with this diversification.

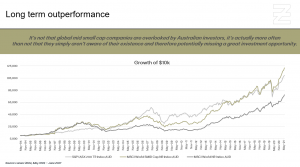

Strong Returns

The long term chart below demonstrates how incredibly well the Global Mid Small Caps have performed versus the ASX200 and MSCI World. You get the diversification without giving up returns – very interesting set up.

The other takeaway from this, is that although we don’t invest based on a benchmark we are measured against a benchmark and we are measured against one of the strongest benchmarks in the market.

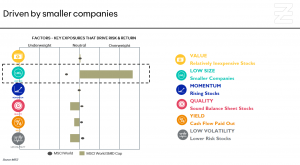

So, where does the growth come from? The chart below from MSCI show some of the factors – key exposures that drive key risks and returns. Size is the biggest factor in terms of risks / returns long term. This makes intuitive sense as it easier for a 2 billion market cap company to double rather than a 2 trillion market cap company.

Another angle that is just as, if not more important, is that a lot of these companies are highly focussed in specific industries and they are run by highly engaged management teams which typically have a lot of skin in the game. That gives you some concentration in terms of exposures from that perspective, which makes us think that it is not just size that drives performance, but the strong focus associated with Mid Small Caps.

Case Studies

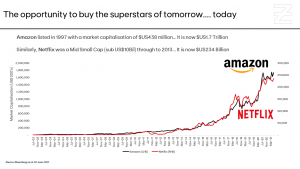

You might find this hard to believe but Amazon & Netflix started their lives in the Mid Small Cap world. The chart below highlights where some of these businesses can go over a period of time. You are investing in the winners and large cap companies of tomorrow.

These companies operate on a global platform; on a global scale; intuitively, it makes sense: they have a global addressable market where a lot of the domestic companies may just have the domestic market in terms of their opportunity set. They have massive total addressable markets to work with and that’s why a lot of these Mid Small Caps can become very large businesses over the very long term.

Ellerston Global Mid Small Cap Fund

And these are the companies we love to invest in: ones that compound returns in a large addressable market over very long period of time. That’s our sweet spot.

You can watch the webinar recording below:

Next Webinar

The next Ellerston Global webinar will take place on 19 August 2021 at 10am AEST and you can register here.

Find out more

Should investors have any questions or queries regarding the Fund, please contact our Investor Relations team on 02 9021 7701 or info@ellerstoncapital.com or visit the Fund’s page.