Ellerston Asia Growth Fund Complex ETF

Minimum initial investment amount: $10,000

Minimum additional investment amount: No Minimum

Recommended investment period: Minimum 5 years

An actively managed, concentrated portfolio listed companies that is benchmark independent and has a focus on capital growth and downside protection.

The Fund is available as an Unlisted Fund or as an ASX Quoted Fund (ASX:EAFZ)

Apply Now

The Fund offers exposure to strong companies in one of the world’s fastest growing region. The Fund targets high quality, large cap companies that provide sustainable growth.

The Fund blends macro insights with investable long-term themes and company analysis within a highly disciplined, repeatable investment process. Its unique, proprietary and multi-step approach to ESG is embedded throughout the investment process and is measured against the benchmark.

Significant harm sectors including controversial weapons and tobacco are screened out as are other sectors including nuclear energy, coal, palm oil production, gambling and pornography.

Disclaimer

| As at 30/06/2025 | 1 Month | 3 Months | 6 Months | 1 Year | Since Inception p.a.* |

|---|---|---|---|---|---|

| Ellerston Asia Growth Fund Complex ETF | 4.33% | 7.89% | 6.81% | 17.93% | 15.12% |

| MSCI Asia ex Japan (non-accumulation) | 3.78% | 6.08% | 6.89% | 16.54% | 12.35% |

| Alpha | 0.55% | 1.81% | -0.08% | 1.39% | 2.77% |

Disclaimer

Disclaimer

| Fund Name | 31/12/2024 | 30/06/2024 | 31/12/2023 | 30/06/2023 | 31/12/2022 | Distribution Frequency |

|---|---|---|---|---|---|---|

| Ellerston Asia Growth Fund Complex ETF | A$0.1809 | A$0.1111 | Nil | Nil | A$0.0006 | Half-Yearly |

Disclaimer

The Fund is available as an Unlisted Fund or as an ASX Quoted Fund (ASX:EAFZ)

Investors can also invest in the Fund by purchasing Units on-market through a stockbroker. The ASX website has a full list of stockbrokers if no relationship exists. If you have an online trading account, you can use ticker code ‘EAFZ’ and invest immediately.

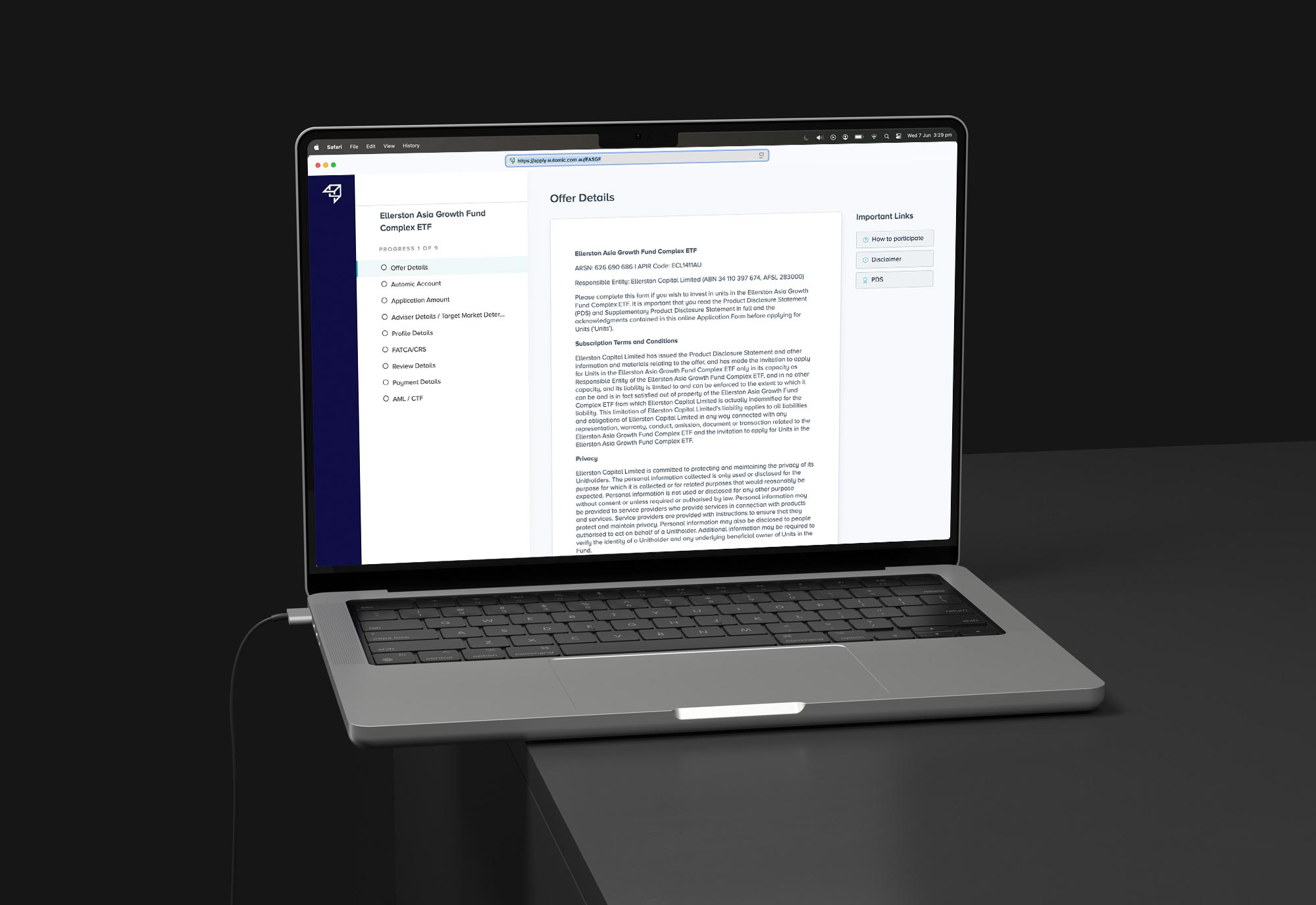

Investors can invest in the Fund by applying for Units by completing the online Application.