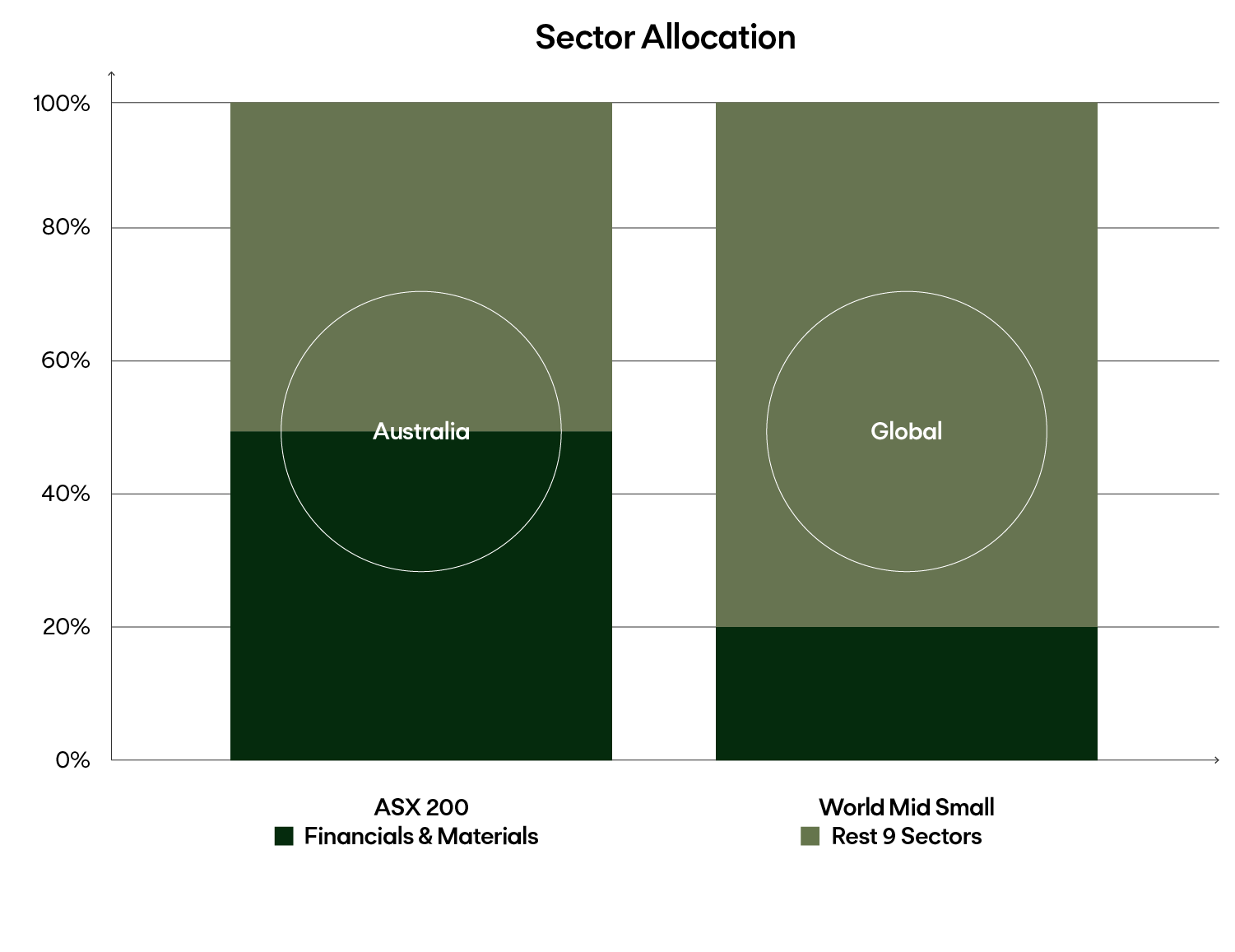

Access the largest, most diversified opportunity set.

Investing in Global Mid Small Caps provides portfolio diversification benefits. There are simply a lot of companies to choose from. The ASX 200 has 200 companies but we have thousands of companies offshore to choose from and the beauty is that a lot of them don’t have a lot of research coverage.